This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

The last quarter of 2024 is bound to be an eventful one for retailers, with holiday shopping well underway and the presidential election outcome waiting in the wings. As we turn the page on October, here’s the tea on five key trends retailers should expect in Q4. All insights are derived from CivicScience’s database of more than five billion consumer responses.

1. In-store shopping leads.

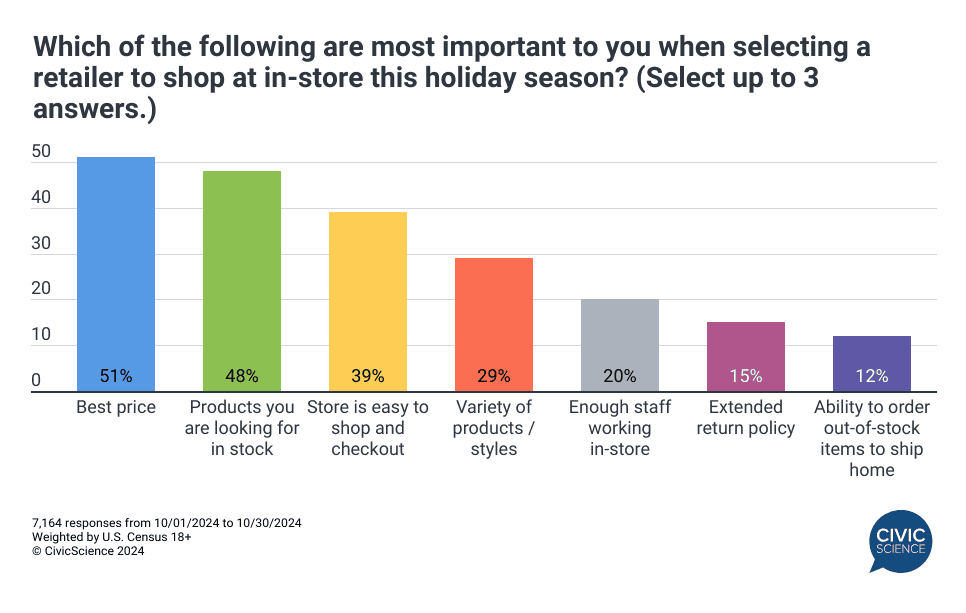

As of October, 87% of holiday shoppers plan to shop online this year, but just 45% plan to do the majority of their holiday shopping online. That leaves plenty of shoppers heading to stores, with even more interest in mall-shopping this season. In-store holiday shoppers say price is the leading factor when choosing which retailer to shop, followed by items they’re looking for being in-stock.

Take Our Poll: When do you start your holiday shopping?

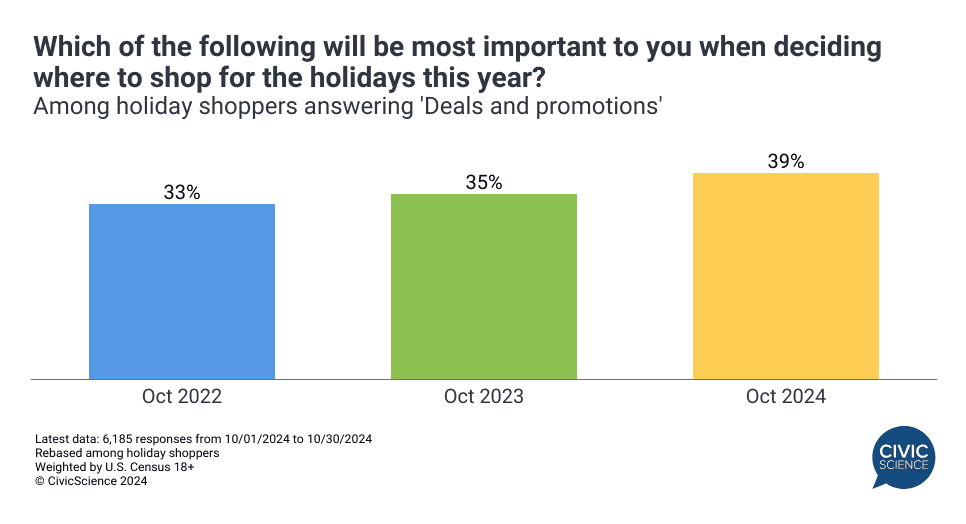

2. Sales, sales, sales.

Deals, discounts, sales, promotional offers – these are top priority for this year’s holiday shoppers. Black Friday and the Thanksgiving holiday weekend should be a major driver of retail sales this year.

3. Skimpflation, across the nation.

Heads up, U.S. consumers are wising up to the practice of “skimpflation,” where brands cut costs by skimping on quality. Restaurant, grocery, and clothing are the top categories where they’re seeing skimpflation, with more than 40% who have noticed lower quality products.

4. If the price isn’t right.

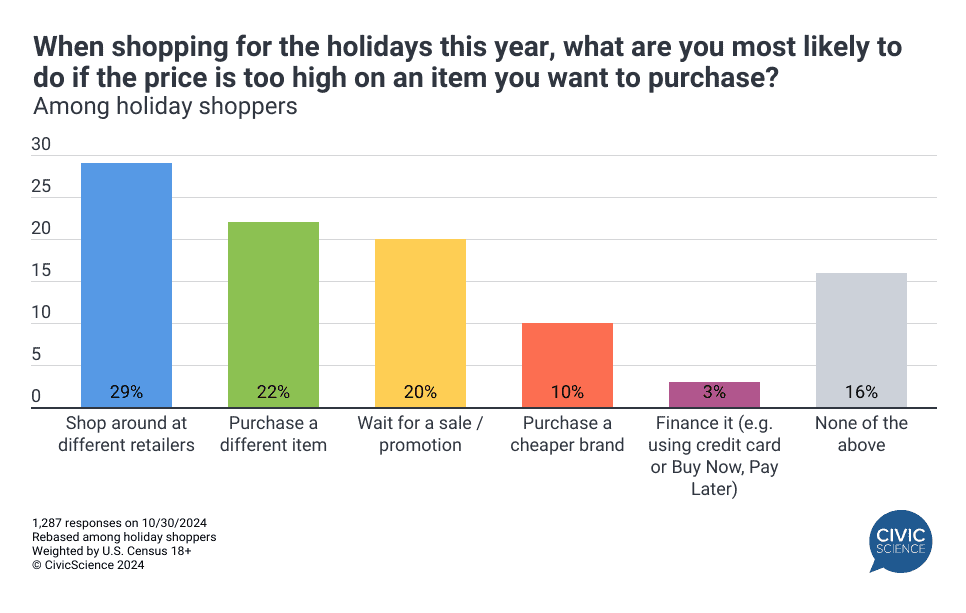

Inflation may be cooling, but the continued high cost of living means less money to go around. That leads price-sensitive shoppers to make tough decisions when holiday shopping this year. Nearly a third – 29% – say getting the best price on a particular item means shopping around at different retailers. Shoppers largely remain split on waiting for a sale/promotion to make the purchase on an item that they think is too expensive, or purchasing a different item altogether.

Join the Conversation: Do a retailer’s sale prices influence your decision to holiday shop there?

5. Election limbo.

Last but certainly not least, the 2024 presidential election is likely to have a significant impact on consumer spending and behavior. In fact, it already has, as 46% say they’re cutting back on their personal spending to some degree due to the uncertainty of the election. Looking ahead, more than two-thirds of U.S. adults report they’re likely to change their spending, investing, or travel plans if the presidential candidate they support loses.

For a deep-dive into the election’s impact on consumer spending, join CivicScience CEO John Dick for an exclusive webinar this November. Learn more here.