This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Halloween is a little under three weeks away, and shopping is in full force among enthusiasts of the U.S. holiday. Based on findings, Halloween shopping reached an all-time high last year, with consumers spending over $12 billion in 2023. But what about 2024? Here are key insights to know about this year’s spooky season:

Halloween Shopping in Flux

CivicScience data show that more people are shopping for Halloween this year. As of October, 28% have shopped or plan to shop, up from 24% last October.1 This could be due in part to an earlier shopping season, as many Americans began shopping for Halloween in July, with Gen Z leading early shopping sprees. Candy and decorations are the top items that consumers have purchased so far this season.

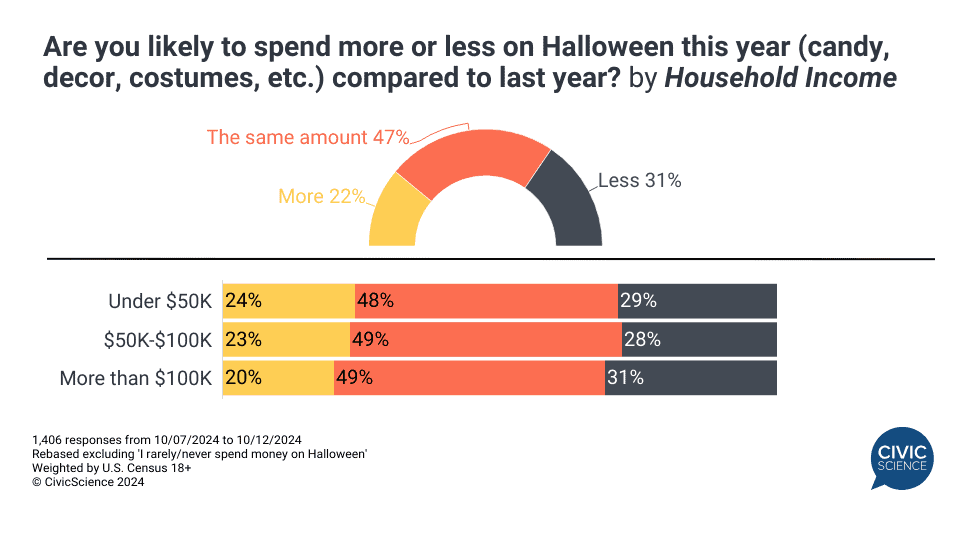

However, total spend per household is likely to be down. Consumers are nearly 10 percentage points more likely to say they’ll spend ‘less’ on Halloween items this year than ‘more.’ That’s not dependent upon income, as data indicate this trend holds true among consumers of all income brackets.

Cast Your Vote: Favorite Halloween decoration?

Online Shopping Gains, Pop-Up Stores Grow in Popularity

More than 211 million people shop online every year in the U.S., but most people prefer to shop for Halloween items in-store. That said, online shopping for Halloween purchases like decor, costumes, and candy continues to climb, although at a slower pace than 2022 to 2023. Data indicate that 77% are buying most of their Halloween items in-store this season while 23% are buying online, up from 21% last year.

Big sales events such as Amazon’s Big Deal Days may be helping to drive more online Halloween purchases. CivicScience learned that nearly 20% of Big Deal Days participants shopped for Halloween items during Amazon’s October sale this year.

Another key trend to watch is that more people are shopping for Halloween goods at specialty pop-up stores, in addition to online-only retailers, while fewer are shopping at big-box retailers this year, such as Walmart. Seasonal pop-up stores like Spirit Halloween are most popular among the under-35 crowd. Most aren’t doing the bulk of their Halloween shopping at home improvement stores, thrift and resale stores, and craft and supply stores.

Trick-or-Treat Candy Holds Steady

The kinds of candy and treats adults will give out during Halloween trick-or-treating this year are similar to last. Most are going with mixed mini-candy bars (54%) or regular-sized candy bars (22%), while fewer are opting for king-sized candy bars this year (-4 points YoY to 10%).2

Behind the Spending: Shifting Attitudes About Halloween

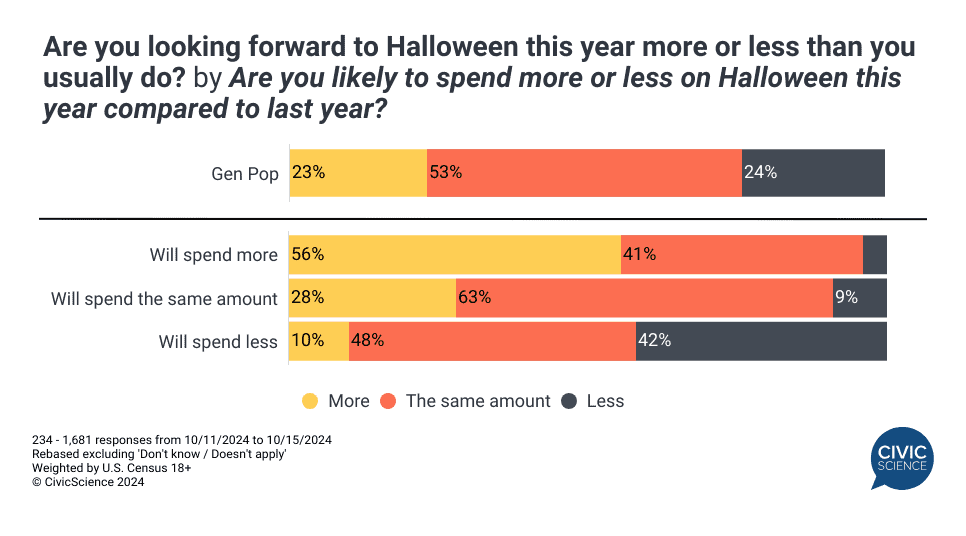

New data show that excitement about Halloween is a mixed bag, with 24% of Americans saying they’re looking forward to the holiday less this year compared to last, and 23% looking forward to it more.

Likewise, fewer people say they are decorating their home for Halloween, despite shopping earlier. Out of those who usually decorate (which equates to nearly 50% of U.S. adults), one-third will not be decorating this year. In comparison, just 16% of people who don’t usually decorate are giving it a go in 2024.3

Data suggest that continued high prices and inflation may be impacting overall sentiments about Halloween. Those who plan to spend more this season express increased excitement about the holiday this year compared to last, while the opposite is true for those who plan to spend less.

Let Us Know: Do you typically purchase Halloween decor for your home?

This Halloween seems to be shaping up to be less stellar than the last when it comes to shopping trends and spending habits. More shoppers are pulling back on spending even though more people are buying items, and purchasing them earlier. The high cost of living, inflation, and economic uncertainty in U.S. and global markets at present are likely impacting how much consumers can spend this year, as well as excitement over the holiday to some extent.