This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Measuring the financial health of the nation is key to understanding the current state of the consumer and predicting how they will react in the months ahead. The CivicScience Consumer Financial Health Index (CFHI) has a pulse on how U.S. consumers expect their personal financial situation to change in the next six months. Here’s what the latest data show:

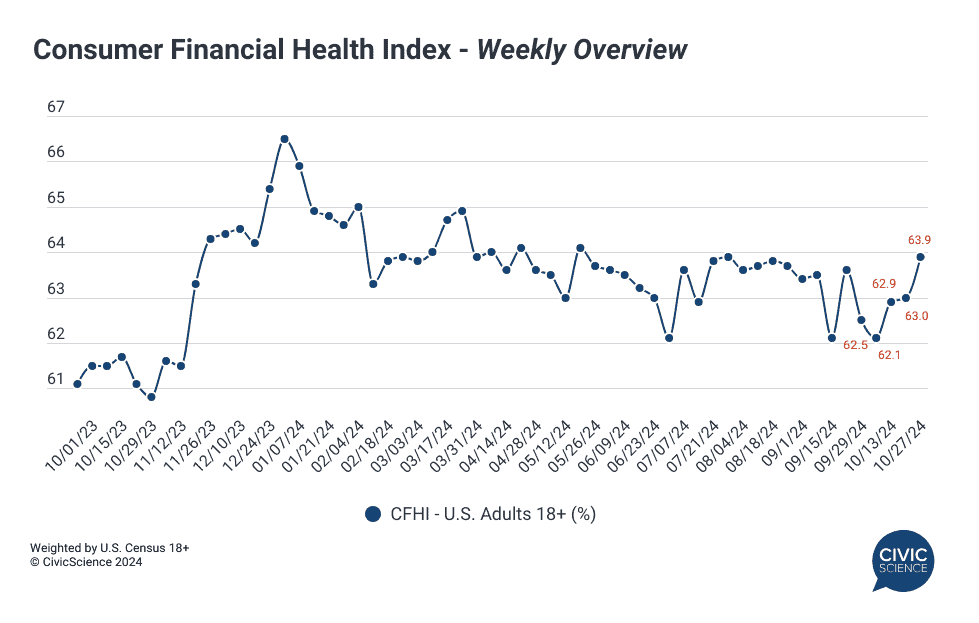

The last couple months have been a series of extreme swings from one week to the next when it comes to the financial health of U.S. consumers. After a sharp decline spanning September to the first weeks of October, financial outlook rebounded by the middle of the month and ended at 63.9%, the highest weekly average since July.

Take Our Poll: How’s your financial health?

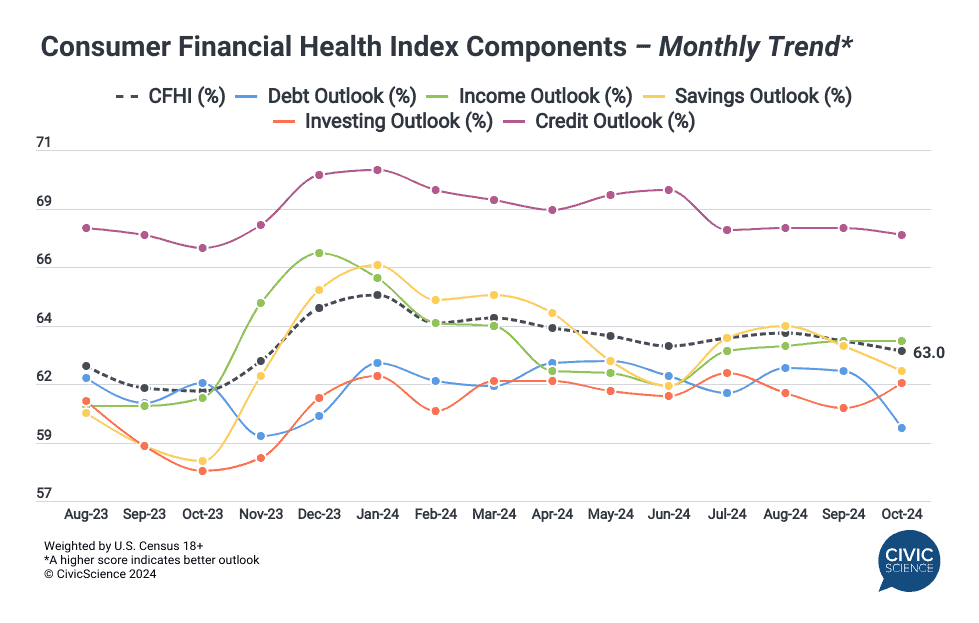

However, the monthly average fell 0.4 points from September to October, brought down by lows in the first half of the month. The biggest driver for this decline? Debt outlook, which plummeted 2.3 points, the single largest drop since 2023. Given debt outlook declined sharply last fall as well, it’s likely that seasonal concerns over holiday-related debt are to blame.

Investing outlook, on the other hand, saw a healthy one-point increase, although savings outlook continued to decline month-to-month.

Credit outlook also worsened slightly, while income expectations remained steady.

Weigh In: How confident are you in the current state of your finances?

The data suggest that savings and debt outlook are the most volatile financial areas to watch in the months ahead, although trends are bound to change based on the results of the 2024 election. CivicScience’s ongoing consumer financial health tracking, as well as economic sentiment and emotional well-being tracking, can help brands navigate the financial impact of the election on consumers in the months ahead.

Future full monthly CFHI updates like those featured here will be exclusively available in our new Consumer Health Tracker.