This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

The effects of inflation have been seen across industries, as consumers tighten spending on entertainment, dining out, beauty, and many others this year. So it’s no surprise that inflation is the number one issue that voters are concerned about in this presidential election cycle. But apart from spending habits, what does the current financial status of the American consumer look like today?

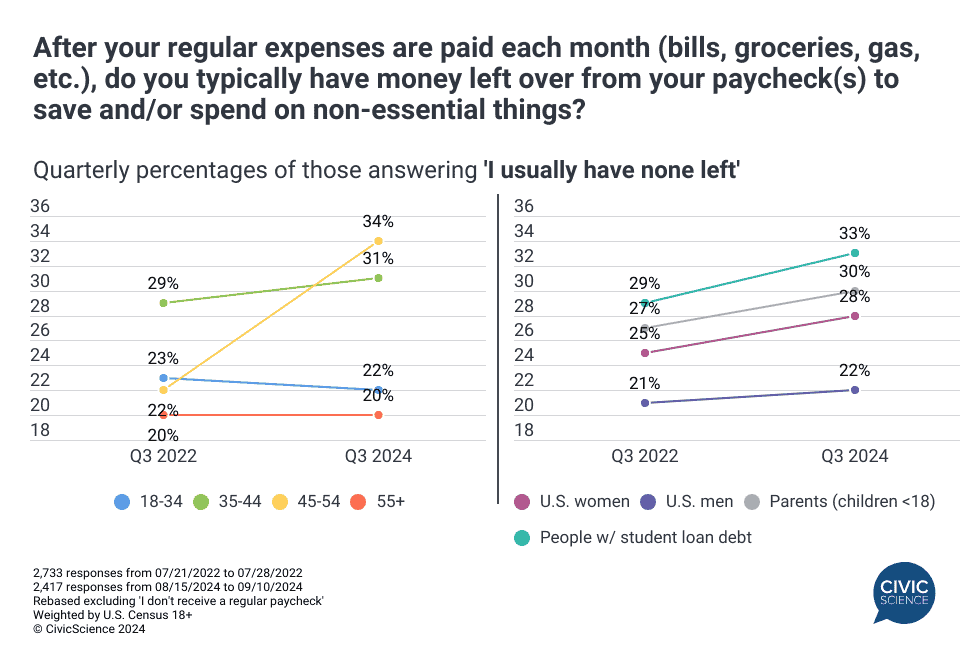

A look back on the last few years suggests an increasing percentage of Americans report they are living paycheck to paycheck. CivicScience data show in Q3 of 2022, a total of 23% of U.S. adults said that after paying for essentials each month, they had no money left over to put toward savings or other non-essential things. That total has risen to 25% in Q3 of 2024.

A majority of Americans have at least ‘a little’ of their paycheck left over (55%), but that percentage has fallen a point since 2022, along with those who have ‘a lot’ left.

Join In: Are you personally living paycheck to paycheck?

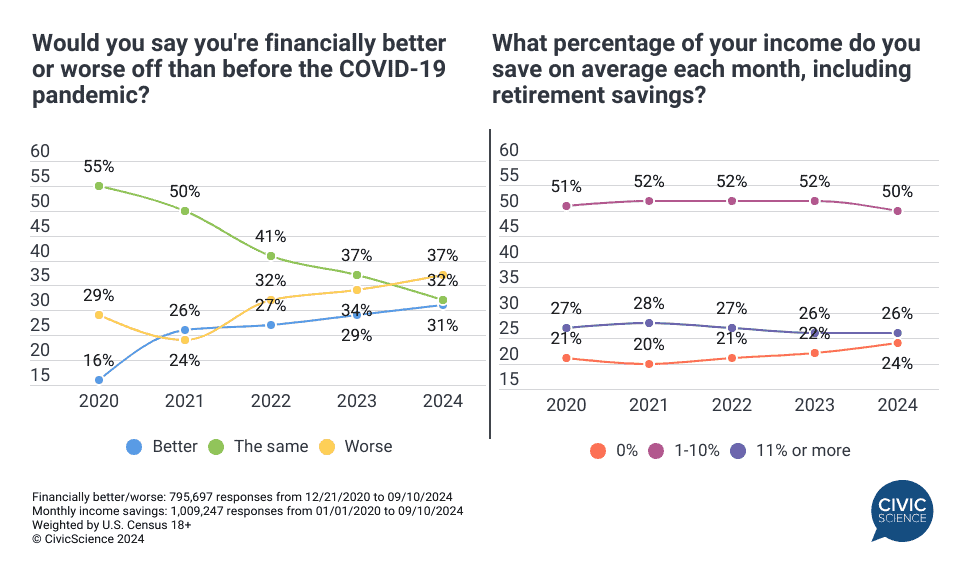

A few percentage points may not seem too alarming, but additional data show that a growing percentage of Americans are finding it difficult to save. Twenty-four percent say they are not saving any of their income (including retirement savings) each month, which marks the highest point since 2020. Likewise, 50% of Americans are able to save 10% or less of their income monthly, but that’s down from a solid three years of 52%.

What does that look like in dollars? New CivicScience data reveal 59% of U.S. adults say they have at least $500 in a savings account on average, but only 34% have more than $3K available. That leaves 15% who have between $100 and $500, and 26% with less than $1001 – a far cry from the $33K that experts say each American should have in savings for emergencies. Things get more dire for people living paycheck to paycheck, as 40% report they typically have less than $100 available in a savings account.

In the big picture, dwindling savings contributes to an overall worsening financial situation for 37% of the adult population – the percentage who are financially worse off now than before the COVID-19 pandemic – which overshadows those who say they are ‘better’ off (31%).

Which Americans have been most impacted?

Data show that certain demographics are more likely to say they are living paycheck to paycheck (i.e., typically do not have any money left from their paycheck after paying for essentials), especially consumers aged 45-54. Today, 34% of Gen X adults are likely to report this status, which represents an increase of 54% from 2022. Older Millennials (35-44) are also more likely to have less money left over.

Unsurprisingly, people with student loan debt are more likely to live paycheck to paycheck: a full third say they have nothing left after paying essentials, up four points since 2022. Women and parents with children under age 18 are also more likely to state they have less to save or spend in 2024.

Make Your Voice Heard: Have you ever had a hard time making it to payday?

Additional insights to know:

- People of all income levels are living paycheck to paycheck: 55% who usually have no money left over earn less than $50K (household income) per year, but 28% earn between $50-$100K and 17% earn more than $100K.

- Job occupation correlates: Craftsmen/laborers are more likely than other occupations to live paycheck to paycheck (33%). However, more than 1-in-5 working in professional/management (21%), operations/sales (28%), and computer/technical/medical (27%) fields are as well.

- Holiday spending will be impacted: 42% of people living paycheck to paycheck say they plan to spend less on the 2024 winter holiday season compared to last year, while 21% won’t be shopping at all.

It’s clear from the data that it’s not just lower income-earners who are experiencing financial difficulty. Student loan debt, parental status, age, and gender all play a role in whether or not someone is more or less likely to experience this type of financial situation. While this has typically been the case, the reality is that the percentage of people living paycheck to paycheck appears to have grown over the past two years as inflation has taken its toll.

Ready to track trends in real-time, uncover hidden consumer insights, and drive winning market strategies?

- 1,576 responses from August 27, 2024 to September 10, 2024 ↩︎