A version of this article originally appeared in ROAR Forward as part of a collaboration with their quarterly ROAR Report. For more retail insights like this from CivicScience, get in touch.

While inflation shows signs of receding and economic sentiment is beginning to recover, Americans continue to have mixed levels of confidence regarding their disposable income and spending as they grapple with elevated costs across various facets of their lives.

Although employment remains historically high for the general population and the 50+ demographic now owns unprecedented levels of wealth due to a recovering stock market and historically high home values, a healthy percentage of Americans are anticipating spending less freely across multiple categories.

In addition to inflation continuing to be a challenge, the Gen Pop will feel the impact of resumed student loan payments this year. However, those without student loans, such as people aged 50+, may feel pressure to watch their spending as healthcare and housing remain elevated over pre-pandemic levels. And all demographics are feeling the pressure of higher food, entertainment, and travel costs.

Looking ahead, how might consumers change their spending habits and what do they anticipate their financial situations to be in 2024? How do those paths differ for various demographics?

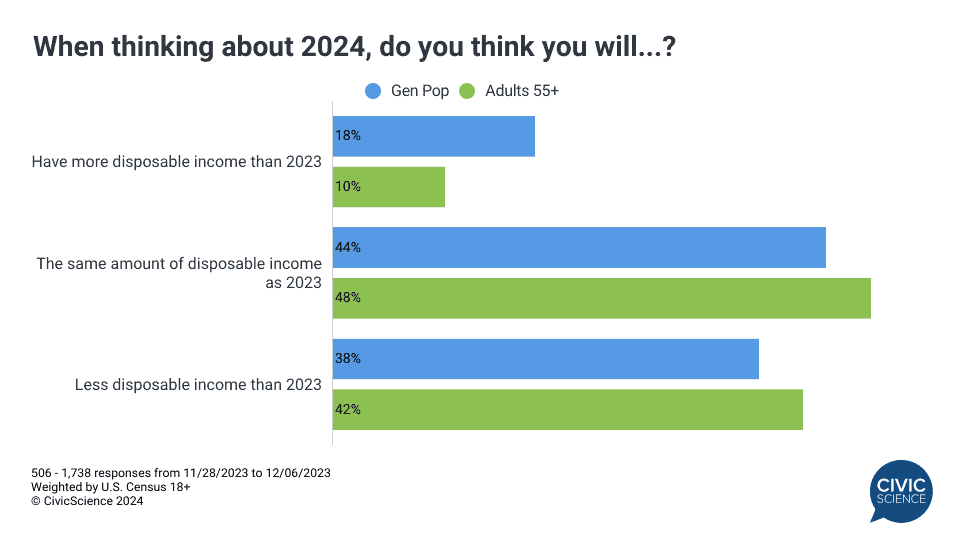

CivicScience recently polled U.S. adults to gain insight into their outlook on their disposable income and spending for 2024. The results indicate over half of the Gen Pop says they will have the same or more disposable income in 2024, with the plurality feeling neutral on their expected income outlook. Still, nearly 2-in-5 (38%) of Gen Pop adults anticipate less in 2024. Adults 55+ who have steadier, less variable, and slower-growing income streams are understandably more likely to have the same (or less due to higher anticipated costs) disposable income this year, with 42% saying they expect less and 48% expecting the same in 2024.

Take Our Poll: How concerned are you about your financial situation in the next year?

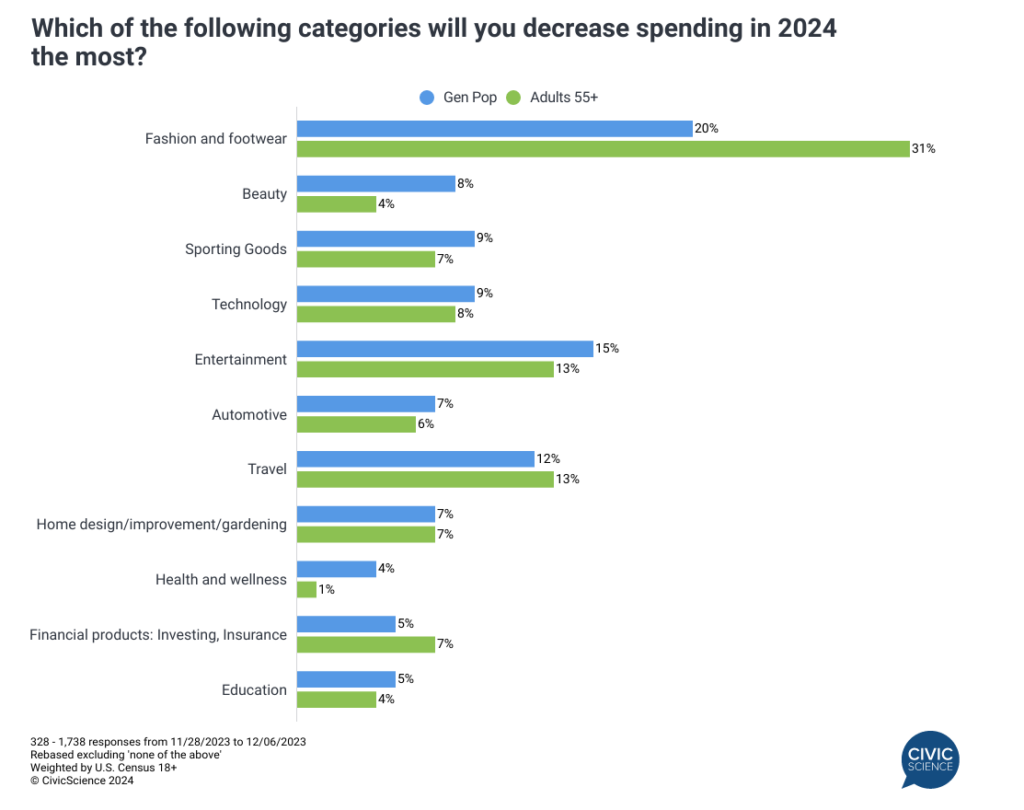

With approximately 40% of Americans planning for less disposable income this year, where exactly are they planning to cut spending in their budgets? Additional CivicScience data show 1-in-5 (20%) say that fashion and footwear spending will be most at risk for Gen Pop and 55+, with almost a third (31%) of 55+ respondents identifying it as their primary area for budgetary reductions. Though entertainment and travel are also common denominators as target areas to spend less, the Gen Pop is twice as likely to reduce spending on beauty products than 55+. Notably, the 55+ segment intends to cut back less than the Gen Pop on beauty, sporting goods, entertainment, automotive, health and wellness, and education.

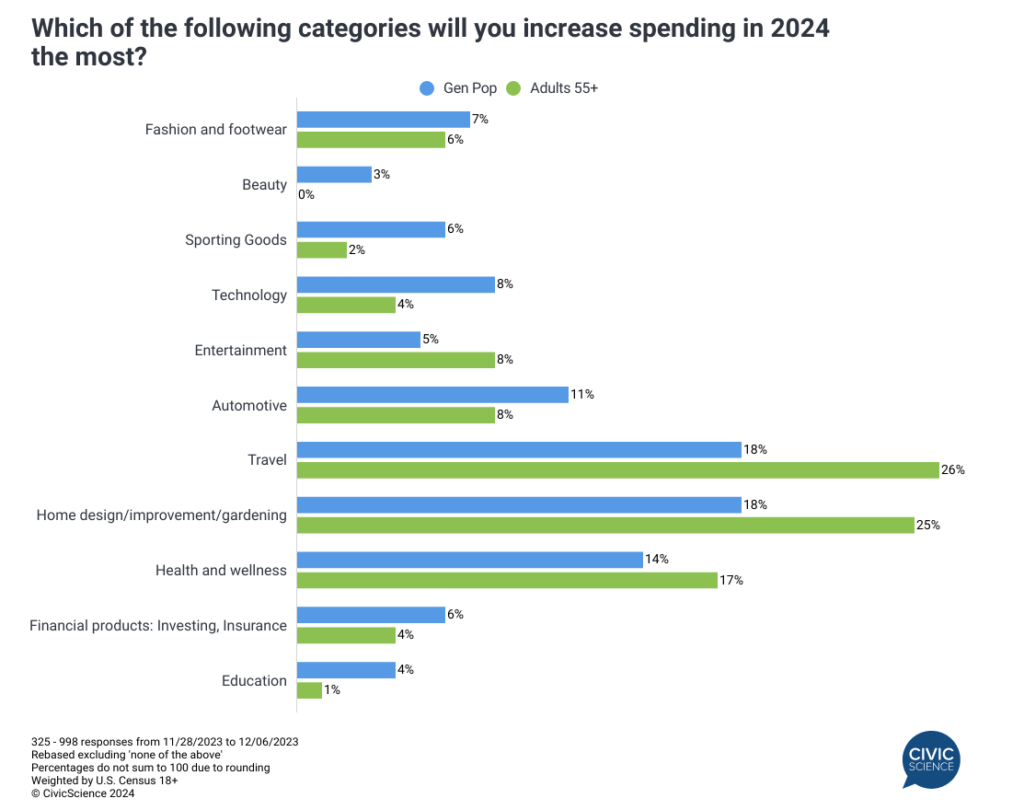

Examining the flip side of the equation, where Americans intend to increase spending in 2024, we find some similarities again – travel, home improvement, and health/wellness stand out as top priorities for American consumers. Not only are a healthy percentage of the Gen Pop and the 55+ segments interested in spending more on those categories, but 55+ is as much as seven percentage points more likely to spend more on travel and their homes than the Gen Pop. Thinking about the 55+ life stage, this intention is understandable as homeownership for the 55+ segment is generally higher than the Gen Pop. Regarding travel, the 55+ cohort, on average, has more time and more wealth than the general population, which can often translate into increased travel spending.

Overall, 2024 is a year where adults 55+ may focus more on trimming fashion/footwear expenses, which distinguishes them from the diversified range of cutbacks expected by the Gen Pop, who are more likely to cut back in 7 of the 11 areas studied. Americans aged 55+ are also particularly honed in on where they’ll be spending more in the year ahead, with over half indicating a preference for spending increases on either travel or home improvement – 15 points higher than U.S. adults citing the same priorities.

Cast Your Vote: Do you plan on retiring in the next 5 years?

Stay ahead of the curve in 2024. To learn more about the benefits available to clients, including access to more than 500K questions available in the CivicScience InsightStore™, contact us today.